Despite the partisan punditry on the cable news shows, most in the business community agree that the U.S. Economy has been on a very good run over the past couple of years.

Much of this article’s content is referenced from a January 23, 2019 article entitled “U.S. Economic Outlook for 2019 and Beyond (the “Article”)” by Kimberly Amadeo.

According to Amodeo:

“The U.S. Economy is healthy according to the key economic indicators. The most critical economic indicator is the gross domestic product (GDP), which measures the nation’s production output. The GDP growth rate is expected to remain between 2 to 3 percent ideal range. Unemployment is forecast to continue at the natural rate (The Federal Reserve estimates this rate to be between 4.5 to 5% of which the monetary and fiscal consider full employment). There isn’t too much inflation or deflation (the target inflation rate to be 2%). That’s a Goldilocks Economy.”

Amadeo believes that President Trump’s target of 4% GDP growth, if obtained and sustained, would be “unhealthy long term” as it could lead to overconfidence and ultimately a “damaging bust.”

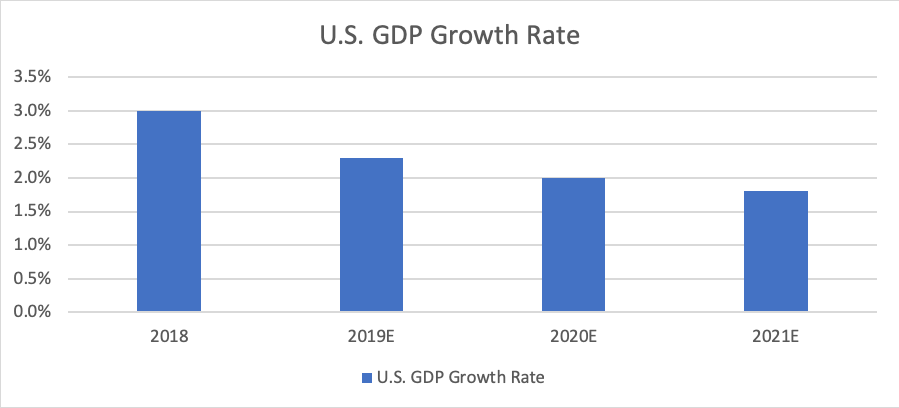

According to the Article, the GDP growth rate will slow from 3% in 2018 to 2.3% in 2019, 2.0% in 2020, and 1.8% in 2021.

Amadeo states that the anticipated slowing of the GDP over the next few years will be the side effect of lengthy trade wars which are a “key component of the Trump economic policies.

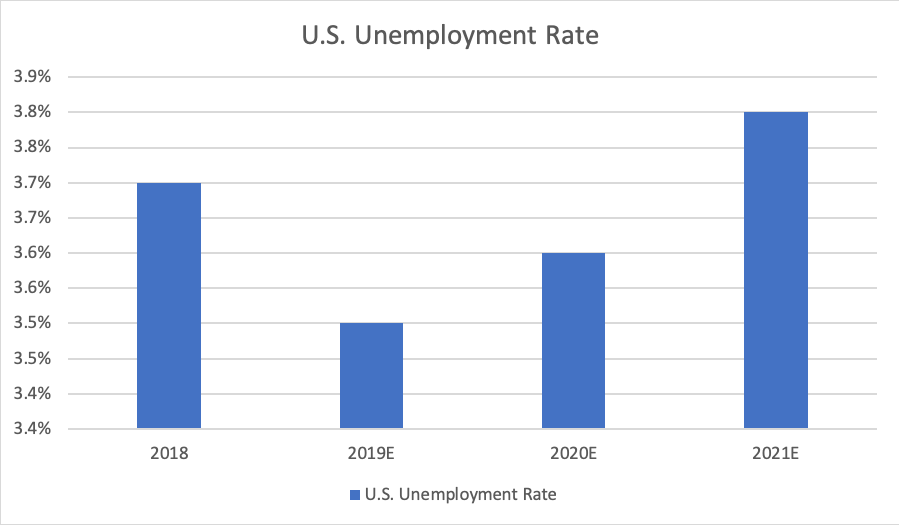

As it related to unemployment, Amodeo reported that the U.S. Economy finished 2018 at 3.7%, is anticipated to be 3.5% in 2019, then increase to 3.6% in 2020, and 3.8% by 2021.

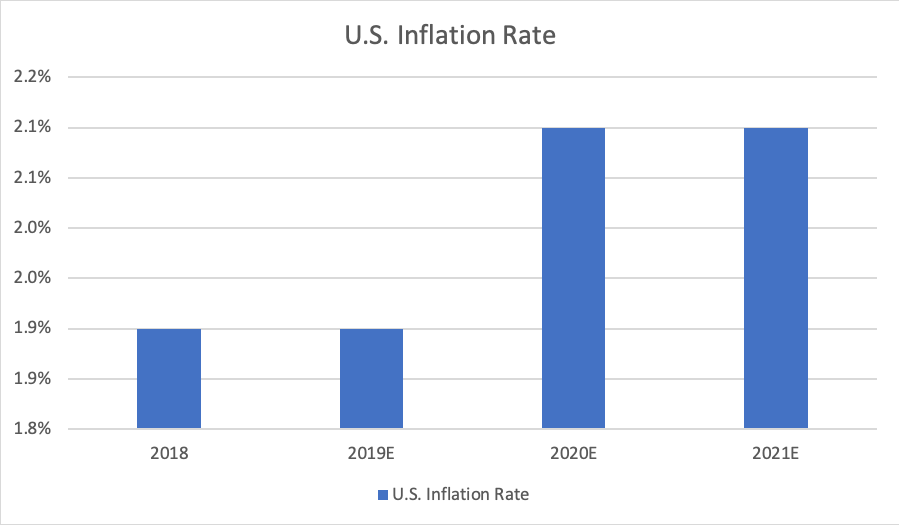

Amadeo also indicated that the U.S. Inflation rate finished at 1.9% in 2018, is expected to remain stable in 2019 at 1.9%, before rising to 2.1% in 2020 and 2021.

When you look at these Goldilocks economic indicators and you marry these with the insights from the Key findings from the series of NAPEO White papers over the last six years, PEO operators and industry stakeholders have to be looking at the horizon with a strong sense of excitement. From all indicators, there does not appear to be any industry thunderclouds on the horizon.

To meld the positive economic outlook with excerpts from the PEO NAPEO White Papers (NWP) between 2013 and 2018, PEOs have a very positive message to share which include the following:

PEO Industry Data Points

- (2016 NWP)– There are approximately 1 million small businesses in the U.S. in which 14-16% use PEOs.

- (2016 NWP)– PEO clients grow 7-9% faster, have 10-14% lower turnover, and are 50% less likely to go out of business than other comparable small businesses.

- (2017 NWP)– 98% of PEO client would recommend a PEO to a small business colleague.

- (2017 NWP)– Annual median growth of small businesses using PEOs were approximately 2x more than those who don’t.

- (2018 NWP)– PEO Industry Size:

- 2017 – $176 billion in annual wages

- 2017 – 8.3% compounded annual growth rate

- 2017 – 907 number of PEOs

- 2017 – the annual PEO worksite employee growth rate is 14x higher than the growth rate in employment in the U.S. Economy

Summary

Buoyed by a strong economy, reduction in unemployment rates, and the increase in wage inflation, the PEO industry currently has the benefit of excellent economic tailwinds. In addition, NAPEO has been an integral factor in the industry’s recent success with:

- the insights provided by NAPEO via education to the small business market in the form of digital advertising

- favorable articles in business magazines and journals

- the investment in market research with industry white papers from the economists and researchers at McBassi

A large number of the PEOs that we have worked with are seeing significant growth in both their size and profitability. We like to think that a correlation exists between our advisory practice’s focus on performance optimization and scalable profitability!!

For those who have not heard me speak at PEO industry events, I restate my personal outlook for the on the PEO industry:

“In the nearly thirty years that I have been in the PEO space as a PEO operator, PEO client and PEO consultant, I have never been more bullish on the industry than today.”

To inject a little political humor on a current industry dynamic in closing this article, our firm has seen a growing increase of caravans of new entrants immigrating into the PEO space from other market verticals.

I just want to let you know that we welcome them all… as long as they are good citizens!

Referenced content

https://www.thebalance.com/us-economic-outlook-3305669

https://www.thebalance.com/goldilocks-economy-definition-causes-effects-3305932

https://www.thebalance.com/natural-rate-of-unemployment-definition-and-trends-3305950