“It is a pandemic. The world is coming to an end. It’s about the science. Stay closed!” The media has been trumpeting this message for the last three months. It is enough to frighten off the faint of heart.

But do not let your hearts be troubled—the PEO industry is very resilient and will adapt, innovate, and ultimately accelerate out of this down market.

NAPEO’s third COVID-19 Survey about the effects of the crisis on PEOs and their clients, released in early June, provides insight into where things stand now and what PEO leaders are thinking about the future. I interpret them with a growing sense of optimism on the prognosis of the PEO industry for later this year and the years to follow.

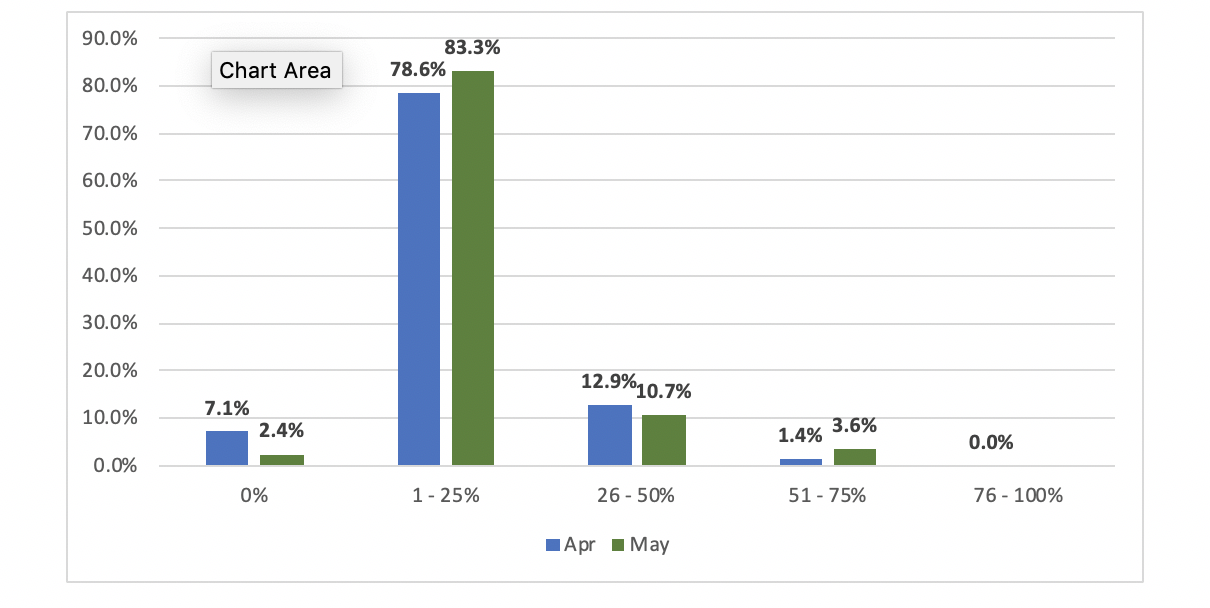

By the end of May 2020, most PEOs had already met their low-water mark (on a worksite employee (WSE) basis) for the year. Of the 84 PEOs that responded to the May survey, nearly 86 percent reported that 25 percent or less of their worksite employee count was lost (2.4 percent were not impacted at all and 83.3 percent were impacted by 1 – 25 percent). See Figure 1.

In my view, this short-term contraction is manageable for most PEOs if they act upon it.

Figure 1. What is the approximate percentage of your worksite employees (WSEs) that have been laid off or let go thus far?

Source: NAPEO’s third COVID-19 Survey, May 2020.

[illustrate figure]

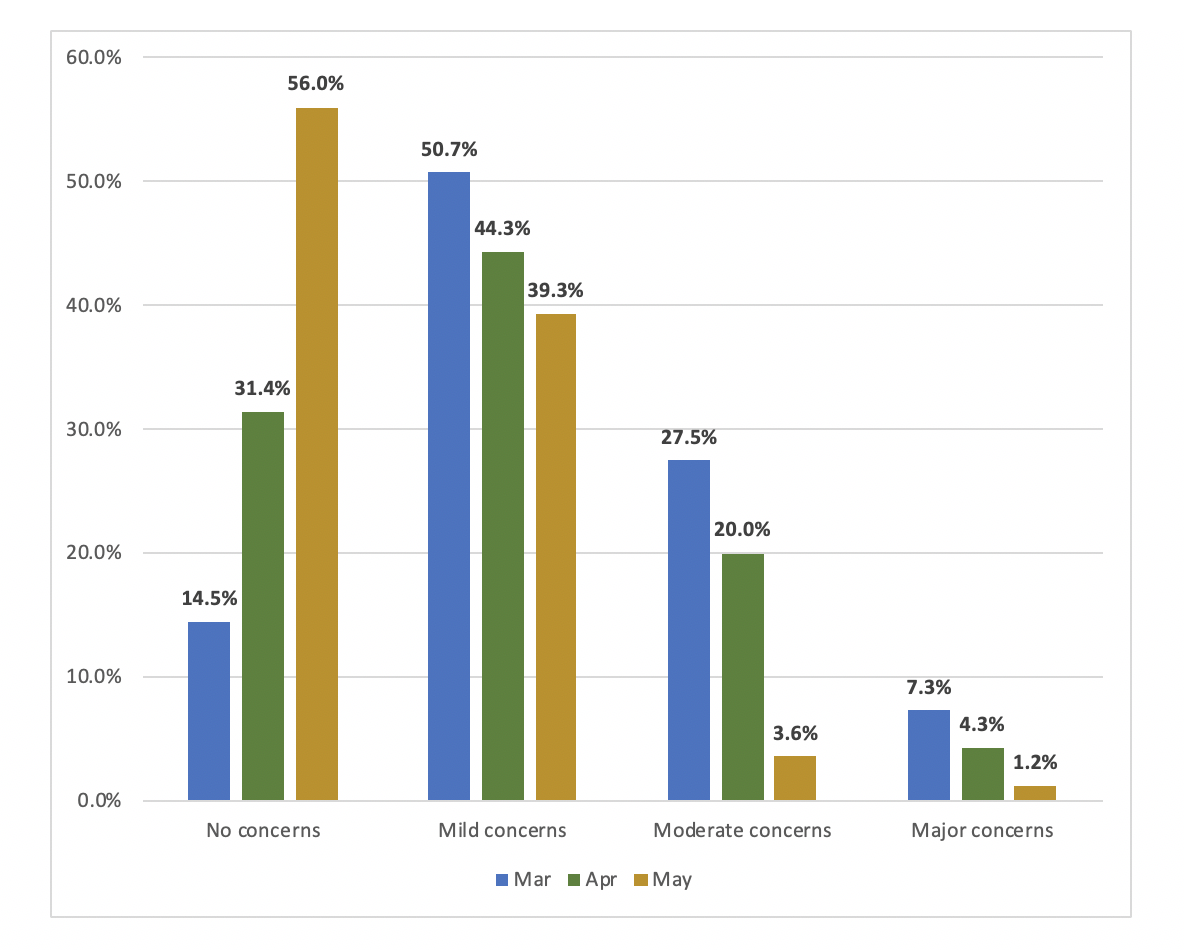

More than 95 percent of PEOs responding to the May survey reported either mild or no concern over the long-term viability of their PEOs (56 percent had no concern and 39.3 percent had mild concerns). The trend lines on this chart shows the growing confidence by executives in the PEO industry over the last three months.

Figure 2. To what extent do you have concerns about the long-term viability of your company, due to the coronavirus? Source: NAPEO’s third COVID-19 Survey, May 2020.

[illustrate figure]

PEO DOWN MARKETS

Last month, I co-presented a NAPEO webinar, “Return to Work, UI, Workshare, and Trends in the PEO Market Today.” In my portion, I discussed my thoughts, perspectives, and observations about the impact of the COVID-19 crisis on the PEO industry this year. (The webinar is available to NAPEO members at www.napeo.org/covid19.)

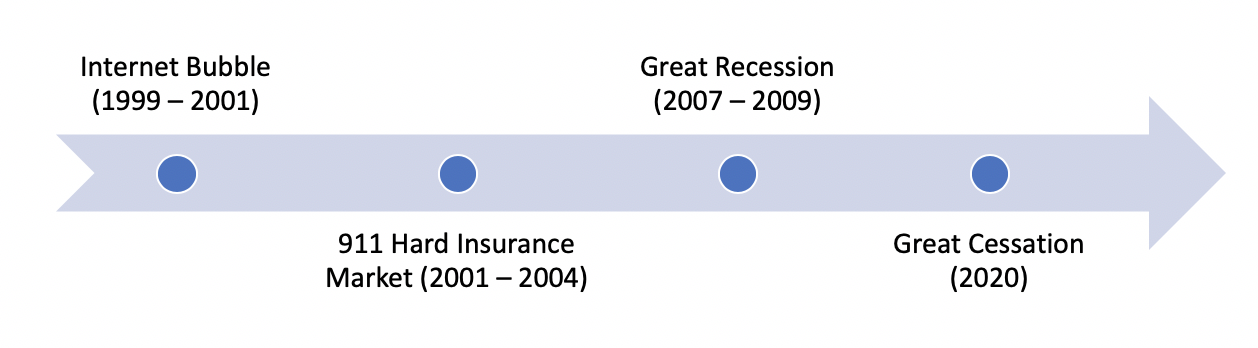

In that session, I provided historical perspectives about the down markets PEOs have experienced in this millennium, shown in Figure 3.

Figure 3. Down markets PEOs have experienced since 2000.

[illustrate figure]

The PEO industry was lightly impacted by first crisis, when the Internet bubble burst in 2001. Even though many of those start-up Internet companies virtually evaporated overnight, the client base of the PEO industry was relatively unscathed.

The second crisis of the millennium had a significant impact on the PEO industry as the property and casualty markets entered a hard market period, which reduced PEOs’ ability to obtain affordable fully insured workers’ compensation coverage. With capacity limited, many of the carriers discontinued offering guaranteed-cost workers’ compensation programs, leaving only unaffordable high-deductible programs that required tremendous amounts of capital to collateralize. As a result, a significant number of PEOs that lacked the capital to collateralize high-deductible programs exited the industry, primarily through consolidation.

The third crisis of the millennium was the Great Recession of 2007, which resulted in major corrections in both the stock market and real estate market that would last for an extended period of time. The impact on PEOs was not necessarily a loss of clients, but a contraction of these clients (much how the COVID-19 crisis has impacted them today). During that period, it took several years for many PEO clients to return to their historic employment levels. Much like the second crisis, a significant number of PEOs exited the industry through consolidation.

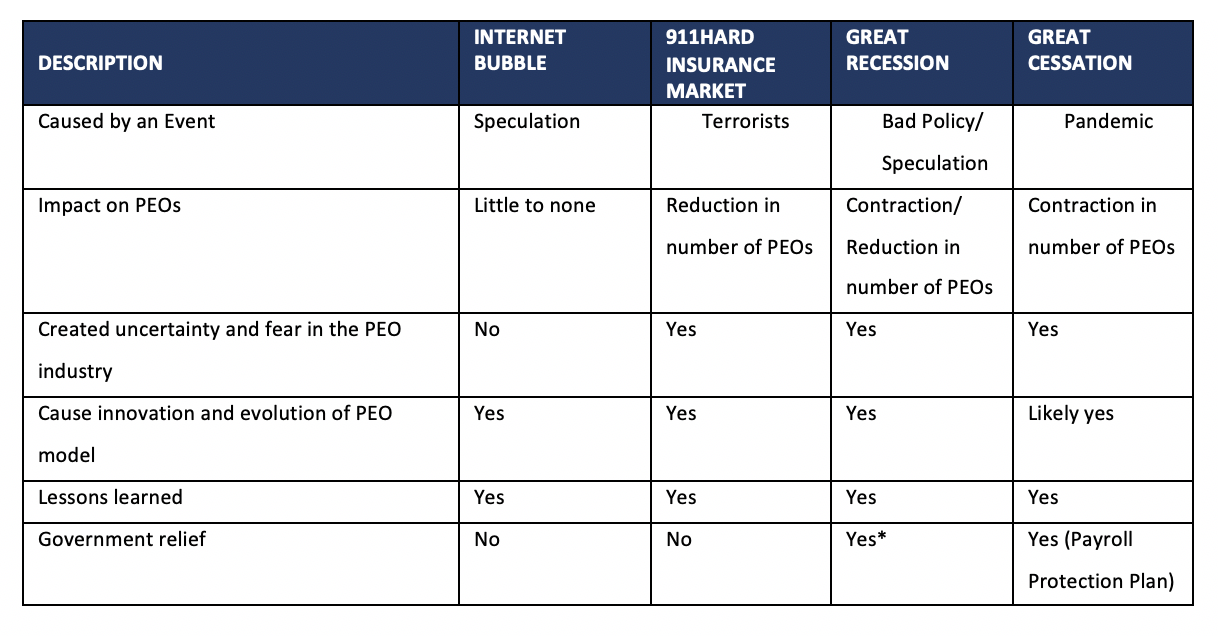

The fourth crisis is the COVID-19 crisis. How is it similar to the other crises? How does it differ from the previous crises? Table 1 compares the characteristics of the four crises.

Table 1. Down markets characteristics in the last 20 years.

[illustrate figure]

* Government relief only for the too-big-to-fail crowd.

* Government relief only for the too-big-to-fail crowd.

LESSONS FROM COVID-19?

What have we learned from this current crisis? The biggest positive result of the COVID-19 crisis is that PEOs were on the national stage proving their value to the small and mid-size business community with education, data and information, and assistance in applying for PPP loans and shepherding them through the process.

Armed with this goodwill, as PEOs accelerate out of this down market, they should take this opportunity to engage their existing client base for referrals.

Additionally, PEOs should take this opportunity to address the flaws and stress fractures within their processes or business models. During the good times, many of these issues are hidden from our view, masked by the tailwinds of economic prosperity by the growing employment and wage inflation of our client bases.

These are the times that make our businesses stronger. Do you play offense or defense now? Now is the time to go on offense and accelerate out of the down market. You and your clients have been given a two-month reprieve with your forgivable PPP loans to get your houses in order, plan strategically, and prepare to move swiftly out of this down market.

I am very encouraged by the most recent NAPEO COVID-19 Survey results highlighted earlier in this article. These results provide evidence that most of the PEO operators surveyed remain optimistic about the long-term viability of their PEOs. This battle-tested and resilient industry has survived three previous crises in this millennium. It will survive and flourish after this one, too. I was bullish on the PEO industry pre-COVID. My position has not changed.

DAN MCHENRY

Business Advisory Group Practice Leader

McHenry Consulting, Inc.

Orlando, Florida

The PEO industry is very resilient and will adapt, innovate, and ultimately accelerate out of this down market.

“Reprinted with permission from NAPEO.”